Our Practices

Our Practices

Litigation

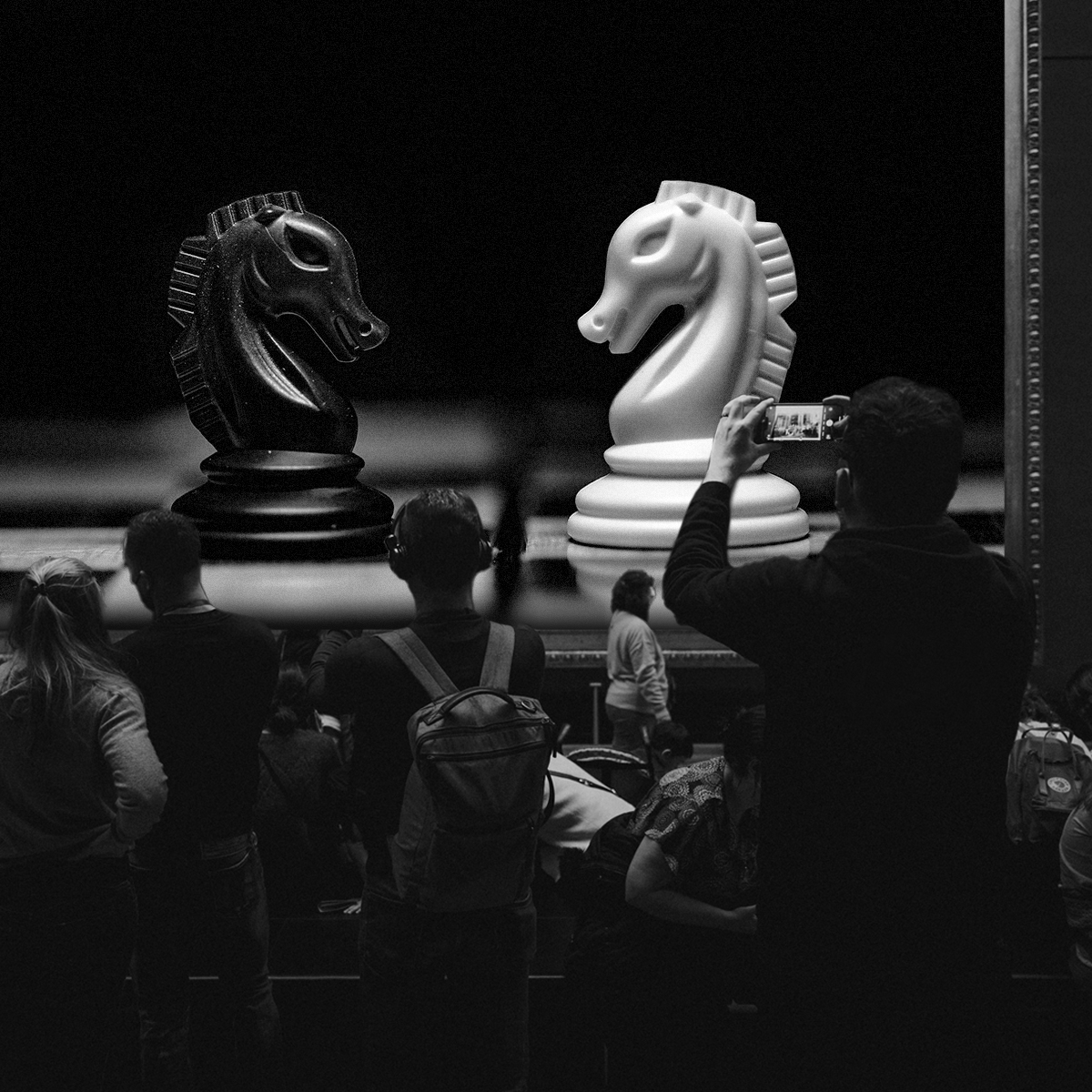

As a recognized “bet the company” litigation team, we are seen by our clients first and foremost as problem solvers.

We are one of the region’s largest, most experienced group of commercial trial lawyers with a proven track record in complex litigation across the United States.

Second-to-none

Our litigators handle each case with discretion, empathy, and attention to detail while keeping sight of the big picture. We tactfully plan our approach and partner with attorneys from across practice areas to assemble a customized, interdisciplinary team that is second-to-none.

While we have the prowess to take your case to trial, we are poised to arbitrate and mediate as alternatives to litigation when it is in the best interest of our clients. We also counsel our clients on ways to avoid litigation altogether.

- Alternative Dispute Resolution

- Appeals

- Bankruptcy Litigation

- Construction Disputes & Litigation

- Corporate Litigation

- Delaware Chancery Court Litigation

- eDiscovery Services

- Employment Litigation

- Financial Services Litigation

- Negligence and Liability Claims

- Patent Litigation

- Professional Services Litigation

- Real Estate Litigation

- Surety and Insurance

- Trademark Litigation & Brand Enforcement

- Trusts & Estates Litigation, Guardianships and Fiduciary Counseling

- White Collar Litigation

Services