2026 Tax Appeal Alert

Presence of a Continued High Interest Rate Environment and Elevated Vacancy Rates Signal an Enhanced Prospect that a Real Property Tax Appeal May Be Indicated in 2026.

As we begin the new year, it is time to evaluate whether your current property tax assessments accurately reflect the evolving market. While inflationary pressures persist and interest rates remain high, we are seeing a complex economic shift. Although there are hints of future rate moderations, these are tempered by record-breaking highs in precious metals—traditionally a signal of broader economic uncertainty.

Across the New Jersey commercial real estate landscape, we are observing several critical trends:

- Office Sector: High vacancy rates remain pervasive as employers continue to downsize their physical footprints, keeping valuations suppressed.

- Retail Sector: Established retailers continue to struggle with bankruptcies and downsizing, further exacerbated by ongoing tariff risks.

- Industrial & Multi-Family: Even these traditionally “favored” asset classes are seeing growth moderate. Industrial vacancy is at a multi-year high, and landlords are increasingly prioritizing occupancy over rent growth.

- Cap Rates: With global instability and a high interest rate environment, capitalization rates are trending upward. Because property values move inversely to cap rates, these market pressures create significant opportunities for property tax relief.

The 2026 Valuation Window

Because the relevant valuation date for your New Jersey 2026 taxes is October 1, of 2025, and commercial property values are inversely related to capitalization rates, the alarm suggesting lower property values has again been sounded this year. As a result, the prospect that these economic forces will work to make real property tax relief available to you in 2026, even if not previously indicated, is now real.

In the upcoming weeks New Jersey property owners will be receiving their annual property tax assessment notices (postcards) from the municipal assessor’s office. Receipt of these assessment notices indicates that the time has arrived to determine whether a tax appeal is warranted for the 2026 tax year.

This notice marks the start of the appeal window.

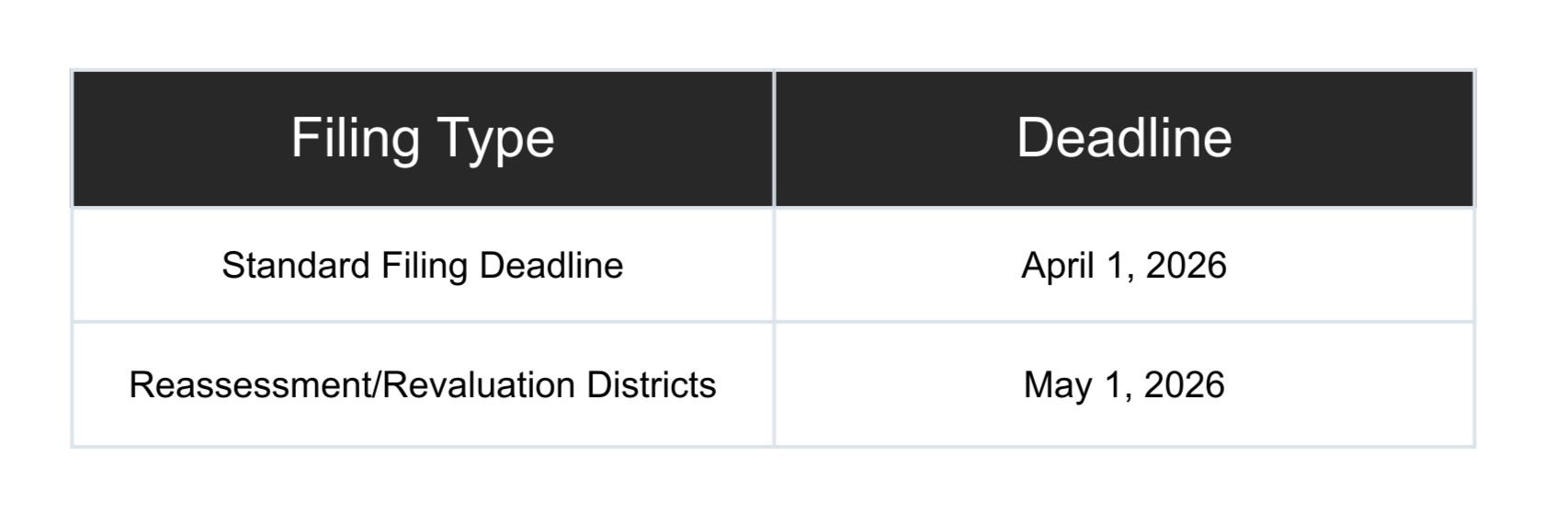

Critical Deadlines

Why Appeal Now?

Commercial property taxes are often a property owner’s largest single expense. Beyond immediate savings, New Jersey’s “Freeze Act” can lock in a successful appeal judgment for two additional years, protecting your bottom line from future increases until the next town-wide revaluation (typically every 5–10 years).

Next Steps

Having the value of your commercial properties examined and an evaluation made as to whether a tax appeal would be warranted in the current market is therefore a property management exercise that is essential at this time. We therefore encourage you to consider this appeal opportunity and stand ready to assist you in the process.

To read more about Tax Appeals, click here.

As the law continues to evolve on these matters, please note that this article is current as of date and time of publication and may not reflect subsequent developments. The content and interpretation of the issues addressed herein is subject to change. Cole Schotz P.C. disclaims any and all liability with respect to actions taken or not taken based on any or all of the contents of this publication to the fullest extent permitted by law. This is for general informational purposes and does not constitute legal advice or create an attorney-client relationship. Do not act or refrain from acting upon the information contained in this publication without obtaining legal, financial and tax advice. For further information, please do not hesitate to reach out to your firm contact or to any of the attorneys listed in this publication. No aspect of this advertisement has been approved by the highest court in any state.

Join Our Mailing List

Stay up to date with the latest insights, events, and more